How to Have a Successful Low Buy Year

A low buy year is really needed with everything going on in the world.

After reading The Psychology of Money and The Art of Spending Money by Morgan Housel, I realized that much of our spending is driven by emotion rather than necessity.

In fact, the things we hoard and the money we spend trying to keep up with friends or neighbors rarely add real value to our lives. More often, they go to waste, clutter our homes and they don’t make us any happier.

Money can’t fill an emotional void. What it can do is buy freedom in the future: the freedom to choose when and how we work, and the freedom to spend time with our children when we want to.

In this post, I share practical tips for a low-buy year. Many of these are habits I introduced in 2025, and I plan to continue them in 2026.

What is a low buy year

A low-buy year is about focusing on intentional spending. It is a way to put your money and energy on what really matters and letting go of expenses that are not necessary and that do not align with your goals.

As a result, it is a great way to save more money, break bad spending habits, appreciate and use what you already have, and reduce clutter and waste.

It’s not about perfection, it’s about doing better. Making small changes every single day which will by the end of the year bring you great results.

How to structure a low buy year

The structure of the low buy year is simple. You need to define the sum you want to save, the sum you need to spend on expenses, and the sum you want to spend as you please.

That said, your low buy year will not look exactly like mine. We have different goals and priorities.

But some steps in preparation for the low buy year remain the same. I will share them bellow.

Review your spending data

It is important to always start with data.

I use a spending tracker and keep track of my monthly expenses. It’s not something I do every single month, but I make sure to do it when I am preparing for the low buy year.

Then, I divide the data into necessities like bills, equipment, food, etc. and non-necessities like treats, going out, presents, subscriptions and so on.

This data gives me a clear picture of my monthly expenses and how much money I spend on non-necessities.

It also enables me to determine where I can save. Sometimes, I get surprised on how much money I spend on unplanned purchases, treats for kids, or snacks I don’t really want to eat!

Identify areas where you can save

After collecting and reviewing the data, it is now time to put an action plan together.

For me, that means pinpointing areas where I should be more careful (putting a limit on kids’ treats, travel plans, or snacks I buy).

Just by raising awareness on how much money is wasted this way, I get motivated to save.

Define clear guidelines

First thing you want to do when your paycheck arrives is set aside a sum you want to save.

Then you decide how much money you want to spend outside expenses.

I also list bigger purchases I want to make during my low buy year (if there are any). It is good to have these bigger purchases in mind during the year so you can prepare and set aside some money.

Work on your mindset change

For me, reading inspiring books or books that help me understand why I spend money the way I do, motivates me to change my daily habits.

This is key to having a low buy year: Changing your mindset for the better and stopping the emotional or impulsive spending habits.

Working on yourself and making sure you spend time on personal development, will not only help you save money but lead a much more fulfilling life.

Don’t aim for perfection

The goal of the low spend year is not to be perfect. The goal is to change your mindset around money, build better spending habits, and learn how to save without feeling constrained.

For me, just realizing how much money goes to waste and realizing how much money I could have saved if I invested it instead, gives me enough motivation to start paying attention to things I decide to buy.

Review your results monthly and yearly

I don’t do this every month, but monitoring expenses monthly and yearly is a great way to keep yourself in check all year round.

Because we all start enthusiastic with great plans, but as months go buy, so does our desire to save. And little by little we give in and start spending way more than we intended.

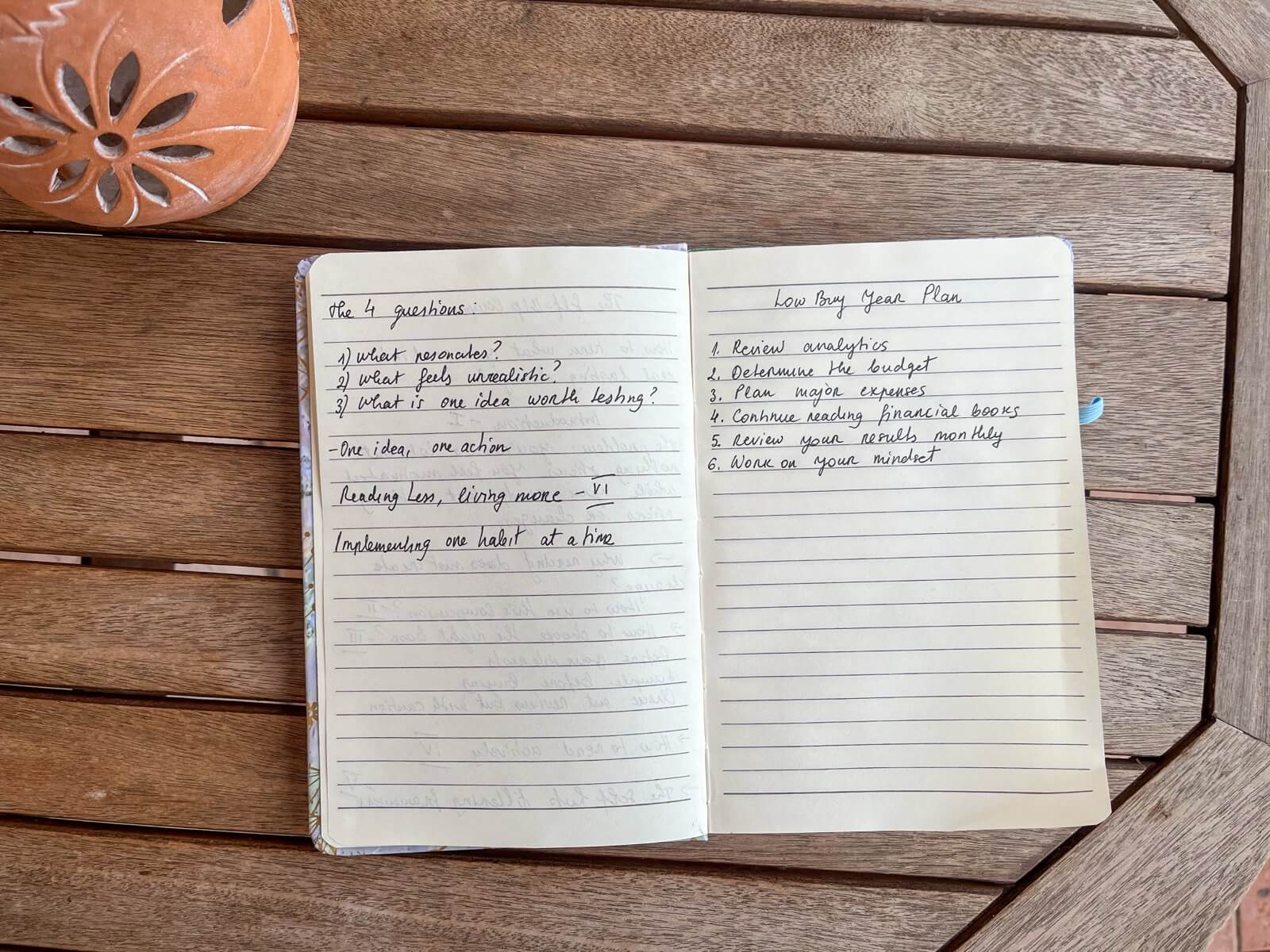

Having a Spending Sheet in your journal is life saving. It clearly shows oscillations between months and keep you on track.

At the end of the year, I do my end-of-year journaling. At this point, I review all spending data for the year and see if I need to change something for next year.

What I plan to do for my low buy year

My low buy year will focus on keeping unplanned purchases as low as possible. I don’t want to go out and buy things out of boredom.

I want to buy things I really need and want. So here are my guidelines for this year:

- Avoid unplanned purchases in store (both food, clothes and books)

- Avoid online shopping whenever possible and adding products into cart that I had no intention of purchasing

- Be more mindful of the electricity I use and save when possible

- Reduce takeout food by planning my meals in advance

- Reduce food wasteage by making sure to only buy what I need

- Avoiding buying beauty products until I use the ones I have

- Actually using clothes I already have, books I bought but haven’t read, makeup I haven’t used up

- Reviewing all monthly subscriptions I have

Final thoughts

“Use money to gain control over your time, because not having control of your time is such a powerful and universal drag on happiness. The ability to do what you want, when you want, with who you want, for as long as you want to, pays the highest dividend that exists in finance.” Morgan Housel

The key to having a low buy year is changing your mindset around money and possessions.

Once you stop valuing material things, and recognize that many purchases are made to impress others, it is much easier to resist shopping.

Start reading and learning and understanding your own spending money behavior and a low buy year will come as a result.

Don’t underestimate small changes you make. They compound over time and by the end of the year will bring you great results.

Related posts

How to save money: Simple habits that work

Book review: The Psychology of Money by Morgan Housel