How to stop impulse buying

In 2025, I decided to stop impulse buying.

I was fed up with the constant buildup of things in my apartment. Stuff I bought on a whim and never truly needed.

My wardrobe was full, yet I had nothing I actually enjoyed wearing. My nightstand was packed with skincare products I had not even opened, and still I kept ordering more. Always convinced that the next product would be the one. The one that would finally be life changing.

That was the moment I realized something had to change.

If I wanted to get control over my spending, I first had to learn how to control my impulse buying.

What is impulse buying?

Impulse buying is any purchase you make without planning it ahead of time.

It happens when you are shopping and see something you did not intend to buy, then add it to your cart anyway. It is clicking buy on an item that was not even on your radar five minutes earlier.

You might do it at the supermarket checkout. You might do it late at night after watching an influencer rave about a product on TikTok.

Either way, it is not something you thought about for weeks or had sitting on a list. It is a decision made in the moment.

Some of the most common impulse purchases include:

- candy, gum, or drinks at the checkout

- unplanned treat yourself purchases

- shoes or clothes you did not need or intend to buy

- takeaway food on the go

- toys or snacks bought to keep kids busy in the store

None of these purchases are unusual on their own. The issue is not what you buy. The issue is how you buy.

Impulse buying is reactive. It happens in the moment, driven by convenience, emotion, or temptation rather than intention.

What drives impulse buying?

There are many different reasons people make purchases. There are also lots of different triggers for impulse spending.

Here are a few common reasons people impulse buy:

- emotions

- lack of self-control

- online marketing

- love of shopping and making a purchase

For me, I tend to buy things when I feel sad or upset. When I am tired and out with the kids, and it is o much easier to buy them something to keep them occupied.

I also like to watch Youtube vlogs, and sometimes I buy products impulsevely because someone raved about them. That especially goes for makeup and skincare.

How to stop impulse buying

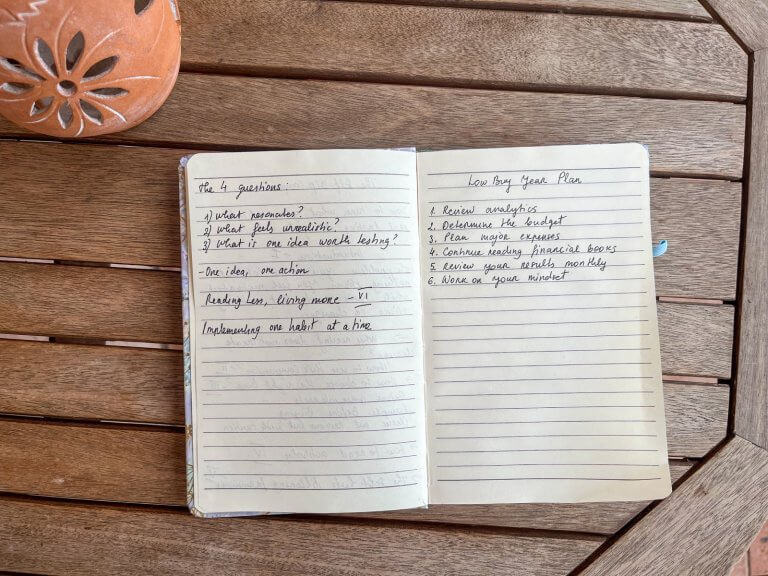

To stop impulse buying, I had to create a few simple rules for myself.

These rules force me to pause, think, and reconsider a purchase before the money leaves my bank account.

Yes, I know you can return things. But the goal is not to rely on returns. The goal is to stop buying unnecessary things in the first place.

These are the rules that helped me stop impulse buying:

Know what you like and stick with it

I created a list of my signature products. My favorite perfume, face cream, chocolate bar. A list of items I genuinely like and I would always use up.

When you have a signature perfume, makeup routine, and skincare basics, trends and hype lose their influence. You are no longer tempted by every new launch because you already use products you enjoy and trust.

It is completely fine to try something new occasionally. But the core of what you use should feel familiar. Products you know work for you and that you actually enjoy using.

Having a clear list of your core products makes impulse buying much harder. Instead of reacting to marketing, you make intentional decisions based on what you already know you like.

Finish what you start

Before I buy a new skincare product, I have one non negotiable rule. I must finish what I already have.

If I want a new hydrating serum, I need to finish the one I am currently using or the one sitting unopened in my drawer.

This rule applies to food, clothes, makeup, and skincare.

It stops me from buying random products just because an influencer is raving about them. It also shifts my focus from chasing something new to actually using what I already own.

Unexpectedly, this rule made shopping more enjoyable. When I finally finish a product, trying something new feels like a reward instead of an impulse.

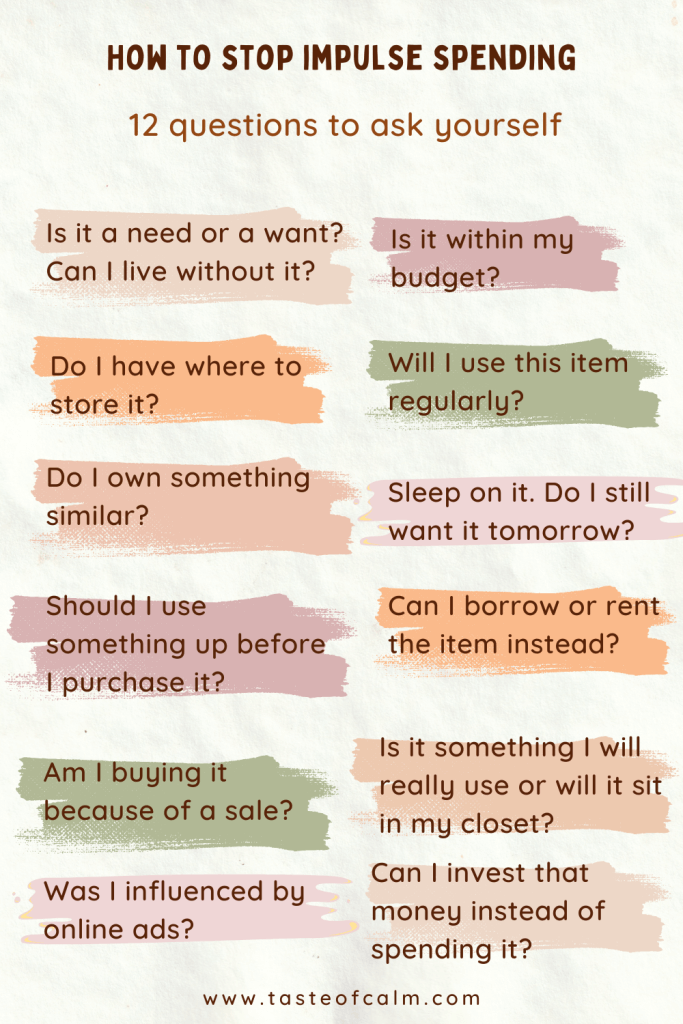

Pause before you purchase

I often add products to my cart and then leave them there.

The key is to not buy in a hurry or under pressure. I give myself time to think about what I plan to order.

I ask myself a few simple questions. Do I really need this? Have I got enough space to store it? Do I already own something similar that I have not used yet? Can I use something I already have instead?

Most of the time, the urge passes.

Do not shop in a hurry or because a sale is ending. You only save money during sales when you are buying core products you already use and know you will finish.

Carefully select who you follow online

Most of my impulse purchases come from YouTube and Instagram influencers.

To curb this type of spending, I had to be honest about what I was consuming online and make deliberate changes to who I follow and what content I watch.

Mosty importantly, I had to reduce my screen time.

The results were immediate.

Almost everything I feel tempted to buy today can be traced back to something I saw online.

When I limit my time on Instagram or switch my feed to recipes, books, or long form content, the urge to buy skincare and fashion items I do not need almost disappears.

In the past, we were exposed to ads mainly while watching TV. Today, advertising follows us every time we unlock our phones.

If you want to stop impulse buying, you have to protect your attention first.

Don’t shop when upset

In the past, arguments with people close to me often triggered shopping sprees.

Buying things became a distraction. A way to focus on something shiny and new so I would not have to sit with the discomfort of the problem I was facing.

This kind of impulse buying cannot be solved with rules alone. It requires inner work.

For me, journaling became the turning point. Writing helped me process my thoughts and sadness instead of numbing them with spending.

When I put my feelings on paper, the urge to buy is not that strong. I no longer needed things to make me feel better in the moment.

Looking back, I spent the most money during the hardest periods of my life. The connection is clear. Emotional emptiness often looks like consumption.

I notice the same pattern today when I see endless hauls online. Constant buying rarely comes from fulfillment. It often comes from trying to fill something that cannot be filled with things.

Shop with a plan

I keep a shopping list on my fridge and add items as I run out of them. You can also use a shared app so the whole family can add what is needed.

Going to the store with a list makes a huge difference. When you know exactly what you need, you are far less likely to buy random products that were never part of the plan.

A list keeps you focused. It removes decision fatigue and limits distractions.

I notice it every time I forget my list. I end up buying things I do not need and forgetting the items I actually wanted.

Being organized may sound simple, but it is one of the most effective ways to save money and avoid impulse buying.

Remove temptation

Many of my impulse purchases came from boredom.

Once I realized that, the first change I made was simple. I stopped going to stores without a reason.

Instead of wandering through shopping malls, I chose to go to the park. During my lunch break, I avoided browsing online stores. When I am not looking at products, I am not tempted to buy them.

Window shopping might feel harmless, but it often leads to unnecessary spending. Treating shopping as entertainment keeps you stuck in the cycle of wanting more.

Find alternatives that do not revolve around buying. Go for a walk, read, meet a friend, or simply take a break. These habits are healthier, more fulfilling, and they save you money at the same time.

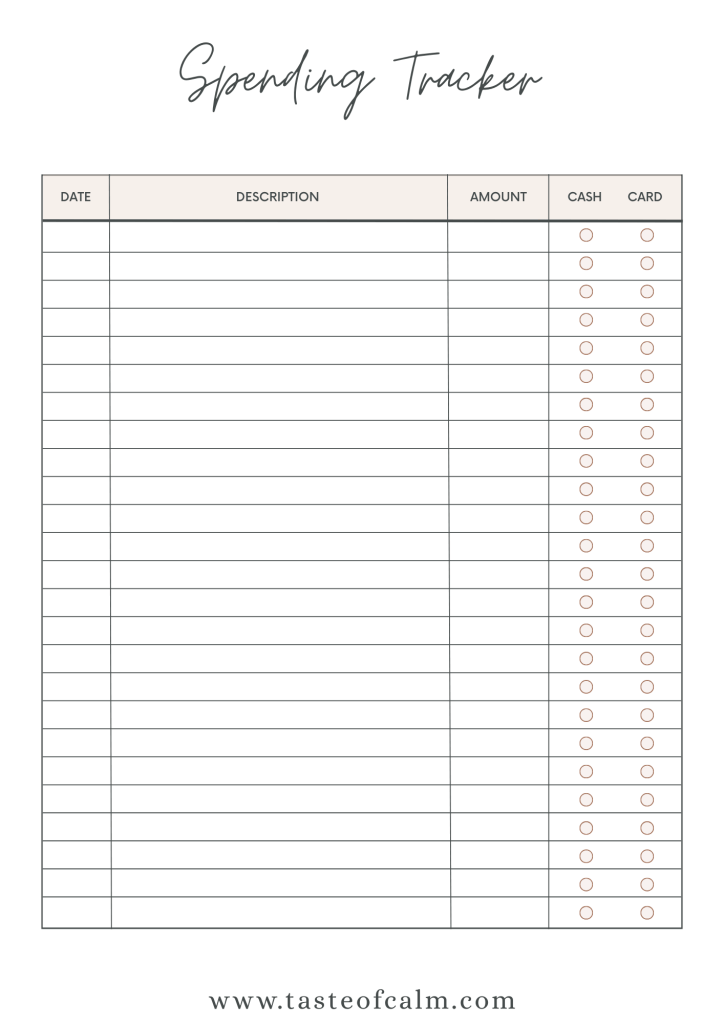

Track your spending

Impulse buying adds up quickly. The problem is that you rarely see the total over a month or a year, so it never feels alarming in the moment.

Once you start tracking your expenses, the reality becomes clear. Small, random purchases can quietly drain a surprising amount of money.

Tracking also brings a powerful realization. You often had enough money all along. Enough to take the trip you kept postponing or to save for something that truly mattered to you.

That is why tracking expenses is so important, especially in the beginning. Awareness comes before control. Once you can see where your money is going, it becomes much easier to change how you spend it.

Download the free spending tracker here!

Final thoughts

Over the past year, I significantly reduced my impulse shopping, and that alone allowed me to save more money and invest it intentionally.

We often underestimate how much money we spend on impulse purchases because they are scattered and rarely tracked. Small, unplanned buys add up quietly.

The benefits went far beyond my bank account. I stopped accumulating things I later needed to declutter. When I do shop now, I feel genuinely excited, and I appreciate the products I bring into my home.

The key is simple but not easy. Buy things you truly want and will use, not things you were subtly influenced to want because someone online was raving about them.

It is equally important to understand the root of impulse buying. For me it is mostly emotional. Learning to respond to sadness and stress with tools like journaling instead of spending makes a real difference.

When you master this area of your life, the improvements extend far beyond money. You gain clarity, calm, and a stronger sense of control over your choices. That shift improves not only your finances, but your overall well being too.

Related posts

How to save money: simple habits that work